HOT OFF THE PRESS: PANDEMIC LUXE

The Bounce Back Challenge for Luxury Brands.

The insights and perspective you need to ride the COVID storm and emerge stronger.

Contact us to find out more

An unprecedented challenge for unprecedented times….

How to bounce back in a Covid world is the $billion question facing luxury brands today. It is an unprecedented challenge in unprecedented times:

• we have a dramatically different luxury category in structure and scale. Covid is the first global crisis to test it.

• luxury was already a category in flux. Coronavirus has accelerated the change

• brands are operating in a high stress context of adapt-or-die. It has been called a Darwinian shake-out.(1)

• we are dealing with a recession-hit consumer, reduced in number and restricted in spend. Normal segmentation doesn’t hold true

There is light at the end of the tunnel – there is pent up demand; China is already showing signs of recovery; emerging markets will return; and prices will one day recover. The goal is to ride the storm and emerge stronger, ready to reap the rewards of surviving luxury’s biggest, most death-defying challenge.

Consumer Confidence = The Silver Bullet

Increasing consumer confidence is the first hurdle for luxury brands. Let’s not forget. The pandemic has built opportunity for the few. The super-rich have a history of doing well out of a global crisis. They recover well. They make money from it. Their entire entourage benefits. They have a fast-tracked ability to ride the rebound.

For the majority, 2020 is characterised by a sharp nose-dive in consumer confidence across the board.

• Consumers have moved from FOMO to pure fear. In research by Accenture, 64% of UK consumers were worried about their own health, 82% about the health of others, and 88% about the impact on the economy. (2)

• There’s less interest in top level needs as consumers refocus on basics. 2

• There’s less buoyancy in spend as (U)HNWs see a decline in their assets and are coping with large scale shocks to their businesses and investments

• There’s less urgency to buy as consumers adopt a wait-and-see mentality

To bounce back, today’s luxury market can’t exist on the patronage of the uber-wealthy few. The market relies on activating the confidence to spend amongst a broader luxury consumer base. To do that, luxury brands have to navigate a number of irreversible factors.

A changed lifestyle context

Life has changed for the luxury consumer and the differences are here to stay. There has been a relocation of luxury in an Affluent Urban Exodus. Whilst the uber-rich have sought sanctuary on private islands, yachts, billionaire bunkers, a broad swathe of Affluents have deserted their primary city base and relocated to second homes or rentals. Out of town has become where life happens. Vibrancy moved local. Urban has been put on ice until better times resume. Out of town sales are on the increase. Luxury is not so much re-invented as relocated.

The notion of status radically changes. As the pandemic forces a reassessment of work on all levels, the notion of winning is re-invented. Status is redefined from old to new school winning. The winning mindset gains depth and perspective. Work adapts to a new lifestyle reality. Winning is still the goal but is now humanised

Wellness has become the world’s biggest luxury. Luxury consumers have been confronted – not just with their own- but their entire world’s mortality. As a result, health and wellness take ultimate importance. Consumerism -for the sheer sake of it- appears frivolous and vulgar by contrast. The health of the community becomes the shared responsibility for all. Brands are expected to play their part. All brands post-covid have to be – to some degree- engaged in wellness.

The pandemic has turned a 25 year trend towards digital into a digital explosion. There is now a pervading thought of “If I can do it online, I will”. Digital is now a primary mode of interaction. Shopping is online. Digital Experientialism is where the action will be, working to new codes and cues within a whole new context for style. Be it digital clothing, digital fashion weeks, collaborations and inspirations with gaming, the rise of Phygital through to operating models with digital at its core, Digital Experientialism is a major area for Innovation providing a major injection of freedom and creativity. Brands have to aim at being digital frontrunners, not to simply catch up.

This changed lifestyle context has a number of far-reaching, deep impacts for luxury brands:

1. CONSUMER INSIGHTS Home becomes the new luxury frontier, demanding proper understanding as the new innovation context. Role models shift. Priorities change.

2. BRAND DEVELOPMENT Brand positioning needs to be reviewed so the brand can flex its muscles to the full in true relevance to this changed world. New facets need to be engineered into the brand, be it wellness, ethical and human consciousness, or simply a shared spirit of being in it together.

3. PRODUCT RANGE & DEVELOPMENT New lifestyle priorities refocus product relevance and desirability. Luxury goods in demand pre covid now seem to belong to a different era.

4. LUXURY EXPERIENCE Whether it’s catering to an upweighted role within a home-based consumer lifestyle or adapting to a new retail reality, the customer journey has to change in functionality and reward, integrating more entertainment at its core, creating a personalised luxury experience even more enjoyable than before, instilling inspiring rituals

5. BRAVE DIGITAL INNOVATION With digital at the heart of your growth strategy, the challenge is to be a digital frontrunner, not simply digitally adept. The challenge is to create the ultimate luxury digital experience – humanised, 4 personalised, entertaining and interactive- and then brace yourself for the chase to stay ahead.

A changed consumer mindset

All crises throw existing segmentations up in the air.

New segments emerge to correspond with the new mindsets. In the case of this global crisis, Covid has nudged luxury forward into a new stage of development. Signing the death knell on the era of Conspicuous Consumption, Covid has consolidated Luxury Essentialism (3) as the new era that the industry must navigate. Heralding the embrace of luxury as meaningful experiences and things of real personal value, luxury has to elevate your sense of self and have an importance in your life beyond ownership alone. Instead of materiality and materialism, the more intangible constructs of luxury take precedence. Time, space and experience dominate. Longevity and sustainability become vital.

There are 2 factors driving this shift, at their peak amongst Gen Z and Millennial consumers. The first is a consumer who was already becoming woke, taking issue with the waste-producing old-generation business models, with high expectations of purpose-driven sustainable action. (4). The second is the simple reality of less money to spend thanks to uncertainty, unemployment, recession.

4 new luxury segments have risen to the fore as a result:

Segment 1: The Selective Connoisseur, prioritising their investment in pieces that endure the test of time : timeless, understated icons that feel more responsible and project a more centred, discerning approach to luxury consumption

Segment 2: The Ethical Aesthete, expecting brands to take responsibility and play their part in society. Look for brands to reorient their missions and business models in more sustainable and human ways. Are actively changing habits themselves so expect brands to do the same

Segment 3: The Revenge-spending Hedonist. Keen to make up for lost time, they seek to get back out there with abandon and remind 5 themselves of the heady whirl of indulgence. Particularly relevant to China.

Segment 4: The Market Player. Masters of the Savvy discount mindset, they take pride and status in identifying what they want to buy (eg at catwalk) and then tracking it as prey throughout the season to buy when the price is right.

The impact for luxury brands is the necessity to review brand strategy on 2 levels. Firstly, in relation to consumer segmentation: how do these new segments interact with existing segmentation models? Secondly, in relation to brand positioning : how well does the brand speak to new consumer needs and beliefs?

With Covid drawing a stark line between old world vs new world, no brand wants to look like a relic from the past.

The era of Luxury Purpose

The notion of Brand Authority is being reinvented. The expectation for luxury brands is to do the right thing.

Companies are expected to be Purpose-First, to have beliefs and to be willing to be judged by how they stand up for them. This means active engagement with key issues and a more inclusive sense of society. Whilst luxury may sell to the rich, its responsibility is to society as a whole.

Some impressive examples of Luxury Purpose are emerging in the fashion space:

• Dior’s Io dico io manifesto in celebration of singularity and diversity

• LV Virgil Abloh’s unapologetic Black Imagination on display standing up in his responsibility as a black man in a French luxury house

• Gucci’s new generation solidarity championing the belief that we are all in this together

• At Burberry, Riccardo Tisci’s willingness to stand up as a driver of change, to help build a world that is more secure, more human, more sustainable 6

• Prada’s luxury fundraising as a way not only to reflect times, but to shape them

Gone are the days when brands can keep their beliefs to themselves in fear of stepping out of their area of confidence. Consumers expect brands to champion beliefs and put in place mechanisms to drive change, collaborating with like-minds and allowing inspiring internal voices to speak on behalf of the corporation.

Pandemic Luxe: The Topline

Pandemic Luxe has changed the luxury game. It is a changed trading environment for luxury brands and a changed lifestyle context for the luxury consumer. It is an evolution of the notion of luxury to cater to new mindsets and consumer segments. It is a shift to Purpose as a re-invention of Brand Authority.

The challenge for luxury brands is to bounce back. Ride the storm and emerge stronger.

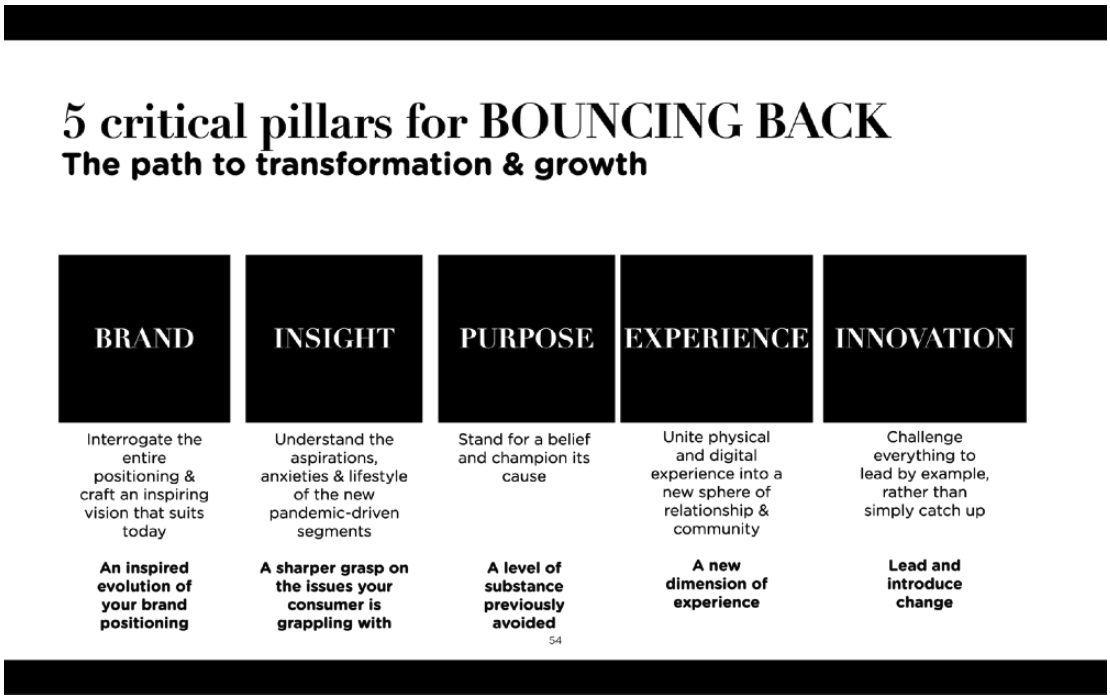

Gone Shopping has identified 5 critical pillars in the path to transformation & growth:

Make Contact

In such challenging, unprecedented times, we’d love to help make a difference to your business. To organise a presentation of the full report, or discuss a particular issue or project, contact Dawn at dawnsgoneshopping.com or call her on 07733314499 Get in touch – we’d love to chat.

SOURCES

(1) The State of Fashion 2020 — Coronavirus Update/ BoF & McKinsey

(2) Accenture COVID-19: 5 new human truths that experiences need to address How organizations should respond to the never normal

(3) https://www.bbc.com/culture/article/20200928-what-is-a-life-of-luxury-now

(4) The State of Fashion 2020 — Coronavirus Update / BoF & McKinsey

(5) https://hbr.org/2009/04/how-to-market-in-a-downturn / https:// www.luxurydaily.com/post-covid-19-luxury-defining-the-new-normal/

(6) https://www.ft.com/content/9c9d1ec2-8898-11ea-a109-483c62d17528

(7) https://www.forbes.com/sites/pamdanziger/2020/05/03/luxury-brands-getready-changing-consumer-priorities-will-result-in-a-trend-toward-the-newluxury-of-wellbeing-after-coronavirus/#a0a3dd3e04d8

(8) https://www.advertisingweek360.com/qa-how-maslows-hierarchy-of-needscan-help-brands-navigate-troubled-times/

(9) https://www.forbes.com/sites/jamesphillipps/2020/06/11/coronavirus-to-wipe-31-trillion-off-high-net-worth-wealth-in-2020/#65354f6333e7

(10) https://www.wealthx.com/intelligence-centre/exclusive-content/2020/ covid-19s-impact-on-the-wealthy/

(11) https://www.luxurysociety.com/en/articles/2020/07/rethinking-marketing-playbooknext-new-normal

(12) https://hypebeast.com/2020/3/moncler-10-million-euro-coronavirus-italy-hospitaldonation

(13) https://www.lsnglobal.com/covid-19/article/25905/stat-at-home-socialisingbecomes-the-new-normal

(14) https://www.luxurysociety.com/en/articles/2020/07/rethinking-marketing-playbooknext-new-normal/

(15) https://www.forbes.com/sites/pamdanziger/2020/05/03/luxury-brands-getready-changing-consumer-priorities-will-result-in-a-trend-toward-the-newluxury-of-wellbeing-after-coronavirus/#a0a3dd3e04d8

(16) https://medium.com/@ParacelsusRehab/how-has-the-covid-19-crisis-affected-wealthy-people-897b9c1dd2cb

(17) https://retailtouchpoints.com/topics/how-luxury-brands-are-responding-tocovid-tension-with-innovation?

(18) https://www.forbes.com/sites/stephanegirod/2020/04/15/luxury-should-usethe-covid-19-crisis-to-accelerate-change/#51bb66926ef0

(19) https://www.forbes.com/sites/stephanegirod/2020/04/15/luxury-should-usethe-covid-19-crisis-to-accelerate-change/#51bb66926ef0

(20) https://www.mckinsey.com/industries/retail/our-insights/a-perspective-for-theluxury-goods-industry-during-and-after-coronavirus

(21) https://www.trendhunter.com/trends/gucci-live

(22) https://coveteur.com/2020/09/29/virtual-reality-fashion/

(23) https://www.vogue.in/fashion/content/burberry-plans-a-phygital-experiencefor-spring-2021/

(24) https://www.admiddleeast.com/in-store/stores/burberry-store-shenzhen-phygitalboutique/

(25) https://www.vogue.com/article/louis-vuittons-new-capsule-with-league-of-legends

(26) https://www.bllnr.com/culture/super-rich-spending-habits-in-the-age-of-corona

(27) https://theimpression.com/dior-fall-2020-ad-campaign/ https:// theimpression.com/dior-resort-cruise-2021-fashion-show-review/

(28) https://theimpression.com/virgil-ablohs-louis-vuitton-mens-show-notes-aremanifesto-fitting-of-the-times/

(29) https://theimpression.com/gucci-epilogue-resort-2021-fashion-collection-review/

(30) https://www.admiddleeast.com/in-store/stores/burberry-store-shenzhen-phygitalboutique/

(31) https://www.afr.com/life-and-luxury/fashion-and-style/burberry-pins-recoveryon-animal-avatars-and-gaming-delights-20200803-p55hzo/

(32) https://hypebeast.com/2020/4/burberry-reburberry-sustanabile-edit-labelsdetails

(33) https://theimpression.com/prada-fall-2020-fashion-ad-campaign/